Post-covid recovery plan: EU money is taking its time to arrive

Of the €750 billion in grants and subsidies made available by the NextGenerationEU programme, much has yet to reach its destination. For some EU countries the delays will have serious consequences.

© Eugénie Lavenant

In the summer of 2020, at the height of the Covid-19 pandemic, Europe’s leaders took everyone by surprise by inventing an unprecedented economic stimulus plan called “NextGenerationEU”. The initiative was exceptional, both in terms of its size – €750 billion to be spent by the end of 2026 – and the way it was financed.

For the first time, all the EU’s countries agreed to take on joint debt so as to help the countries worst affected by the pandemic, above all Italy and Spain. This was to be done by means of subsidies and loans, paid out at regular intervals by Brussels to the member states on the condition that they meet pre-agreed goals for reform and investment. The money was intended not only to respond to the public-health crisis, but more broadly to bolster the “resilience” of EU countries over the long term.

The only other condition imposed by the EU was to allocate 37% of the funds to the climate transition and 20% to the digital transition. This left member states plenty of room for maneuver. In the case of France, the objectives chosen included the greening of the state’s car fleet, the reform of unemployment insurance, and even a renovation of historic buildings.

As the final deadline approaches, it is clear that not everything has gone according to plan. In particular, there have been major delays in the disbursement of funds for the main component of the plan, the Recovery and Resilience Facility (RRF), which was allocated €723 billion.

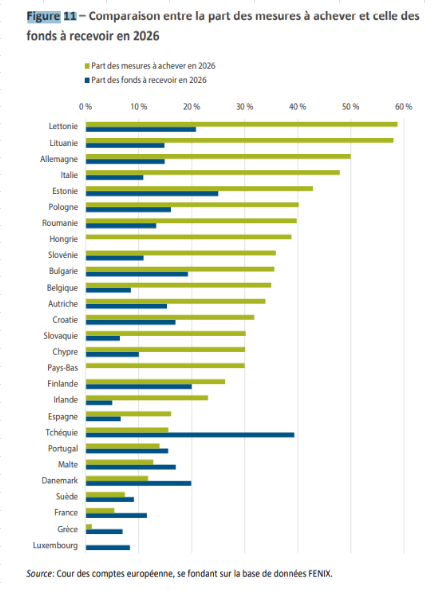

At the end of 2023, i.e. midway through the programme, only 32% of the RRF funds had been paid out to the member states, according to the European Court of Auditors. Take-up rates vary greatly from country to country. At the beginning of 2025, France, Germany and Italy had used more than 60% of their quota, but the figure was only 20% for the Netherlands and Bulgaria.

Hungary, at the bottom of the pack with Sweden (1), has topped out at 8.8%. For its plan, Budapest has only received €800 million in “pre-financing”, which is not conditional on any reform. To receive any further funds, Budapest must first prove that it has achieved 27 objectives, of which 21 are anti-corruption measures and 4 concern the independence of the judiciary. Brussels is thus using the RRF as a lever to promote the rule of law, a goal which it has been pursuing for years. As of today no progress has been made, raising doubts about Hungary’s ability to collect the full €10 billion it is theoretically entitled to.

Apart from this specific case, how can the discrepancies between EU countries be explained? “Some countries have created ad-hoc financing channels to spend the RRF funds. Others, like France, have opted instead to use existing channels”, explains Christian Dubarry, director for Europe at the Banque Publique d’Investissement (BPI), the RRF’s main beneficiary in France, receiving over €2 billion. “It is sometimes less easy for us to trace the amounts spent, because European funds may be combined, in certain calls for projects, with domestic resources”, he explains.

The same is true of the Union des Groupements d’Achat Public (UGAP), France’s eighth-largest beneficiary of the RRF (with €245 million). UGAP acts as an intermediary, connecting selected companies with ministries and local authorities in order to supply them with vehicles, office supplies and other items. “We did not issue any specific invitations to tender relating to the implementation of the European recovery plan”, explains Olivier Giannoni, UGAP’s secretary general. It is therefore hard to know exactly what the money from Brussels has been used for. For its part, France’s finance ministry mentions projects to green the government’s car fleet, as well as to upgrade IT systems in the education sector.

In terms of the timetable, however, several major recipients of RRF money in France claim to have already spent all the sums allocated to them. This is the case for France’s National Research Agency and its €594 million, and France Travail (the national employment agency) and its €278 million. The Centre des Monuments Nationaux, which received €253 million, reports that “of all the projects completed, only two are still in progress, at the Châteaux of Angers and Villeneuve-Lembron”. As far as the BPI is concerned, “all the projects have been selected, the contracts drawn up and the initial payments made,” explains Christian Dubarry. But not always the interim payments, and certainly not the final payments, which will only be made when the projects are completed.

On this point, France is something of a model performer. But at the European level there are worrying signs of delay. According to the European Court of Auditors, by the end of 2023, the member states had only submitted invoices for the equivalent of €228 billion, instead of the €273 billion stipulated in the timetable agreed between Brussels and the capitals. This 16% gap between theory and practice can be attributed to the member states’ delays in following up on their commitments in terms of reforms and investments.

In its latest annual report on the RRF the EU Commission notes optimistically that the delay was less acute in 2024 than in 2023, when the states had to amend their plans to include a chapter on improving their energy sovereignty in response to Russia’s Ukraine invasion in February 2022. By summer 2024, 40% of the funds had been distributed to the states. This reached 47% as of February 2025.

But despite this progress, “delays and difficulties persist for absorbing these funds before the end of 2026”, says the European Parliament’s research service. Yet for the RRF to achieve its objective, “it is essential that the funds are taken up on time”, observes the Court of Auditors. “This avoids bottlenecks […] and therefore reduces the risk of inefficient use of funds and irregularities.”

That is particularly true given that the second phase of the plan promises to be more difficult. This is because the member states set themselves numerous objectives in their national plans, and Brussels must assess whether these have been achieved before disbursing the funds. To give just a few examples: France plans to renovate 827 km of “short” train lines, and is setting up 1.4 million “hybrid” courses in higher education; Czechia is working on a new national medical research centre; and Spain plans a labour reform to reduce the gap in social protection between short-term and permanent job contracts.

But such objectives are not spread evenly over time, points out the European Court of Auditors: “the 73 payment requests submitted before the end of December 2023 covered barely 28% of the milestones and targets”. In other words, the national capitals are going to find it increasingly difficult to obtain the payments made by Brussels as the deadline approaches, due to the sheer number of targets that need to be met first.

It would therefore be premature to declare victory. In fact, the delay in disbursing the money is likely to be much greater than the Commission’s estimate. The Commission focuses on the payments made by Brussels to the capitals. However, what really counts is the moment when these funds pass from the coffers of the states to the final beneficiaries on the ground. And it is precisely “in this last mile that things get stuck”, points out Jérôme Creel, an economist at the Observatoire Français des Conjonctures Économiques (OFCE). So there are delays at two levels: both in the payments made by Brussels to the member states, and in the deployment of funds from the capitals to the final beneficiaries.

Greece, for example, had received €18 billion from Brussels by the end of 2024. But only €12 billion had left the state’s coffers. And those €12 billion included transfers to other public bodies, not just payments to final beneficiaries, which are the real source of liquidity for the economy. In Spain, according to the EsadeEcPol research centre, only 40% of the funds received by Madrid at the beginning of 2024 had been distributed on the ground.

On average in the EU, by the end of 2023, only half of the funds received by the capitals had been paid out to the final beneficiaries.

How to explain this fact when there is such a pressing need for investment? The European Court of Auditors has tried to put things into perspective. It suggests that most of the delays are down to changing economic circumstances: energy shocks, inflation, and disruption of supply chains.